Each month when we’re gathering the latest data for the Cultural Enterprises Commercial Performance Barometer, we ask members a special question around one aspect of their commercial performance. In November 2025 we asked about their plans for increasing entry fees in 2026.

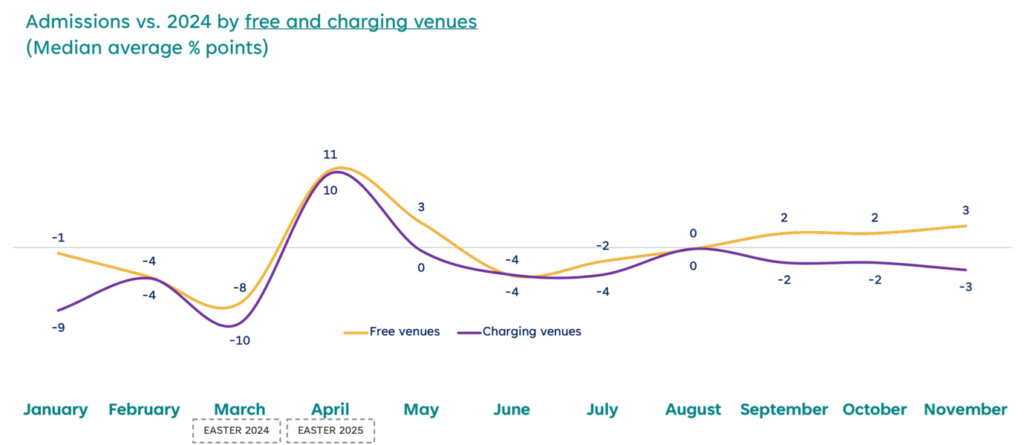

The question was asked in the context of admissions at charging venues tracking well below free venues in 2025 (see chart below), implying that entry fees are currently acting as a deterrent to visiting. Other measures such as a high savings ratio (ONS) also point to a more financially cautious consumer.

The implications and historical context

For charging venues this creates the conundrum over whether to make up for the short-fall by increasing prices (and hoping admissions don’t fall further), or freezing/reducing prices to get more people through the gates. VisitEngland’s Visits to Visitor Attractions report suggests that in recent years attractions have opted for the former – prices increased by 7% on average last year, and 8% the year before. However, this was against a more reassuring backdrop of rising admissions – a contrast to what we have seen in 2025.

Pricing intentions for 2026

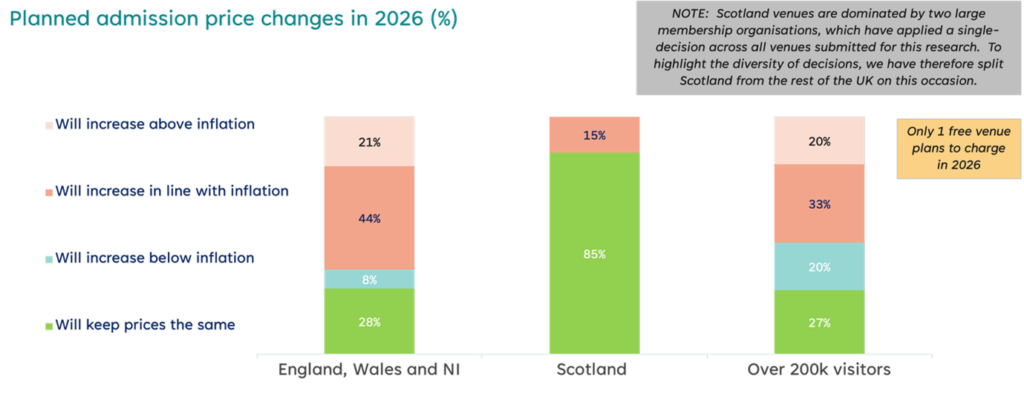

There is no obvious consensus amongst Cultural Enterprises members, but we are perhaps seeing more caution compared to previous years (see chart below). Around 3 in 10 venues in England, Wales and Northern Ireland intend to keep prices the same in 2026, rising to nearly 9 in 10 venues in Scotland (the majority of which belong to two membership organisations that are applying a blanket pricing policy). Of those that are planning to increase admission fees, the majority intend to do so in line with or below inflation, relatively fewer planning to do so above inflation.

Overall, these findings suggest cultural organisations are highly sensitive to a stretched consumer. Whilst there is only minimal appetite for freezing or reducing prices, they are also struggling to justify large price increases.

Every individual case is different but we’d recommend organisations make decisions in the context of these findings, and ideally, conduct research amongst their audiences to understand what they are willing to accept.

Other opportunities for increasing revenue

Of course, increasing admissions is just one way to increase revenue, and a year’s worth of surveys has highlighted a huge range of ways Cultural Enterprises members are doing this. Examples we have come across include:

- Strong, merchandisable programming – the Cats in Cartoons exhibition at the Cartoon Museum a stand-out example of this

- Unique programming to reach new audiences – Old Royal Naval College’s ‘Labyrinth on the Thames’ one of many examples

- Reactive programming – The BALTIC Centre for Contemporary Art’s ‘Road to Wembley’ exhibition responded to Newcastle United’s first domestic trophy in decades

- Selected price increases on retail lines – IWM delivering growth in this area this summer

- Upselling – Again, IWM’s success at upselling guidebooks highlighting what’s possible, even at free venues where customer touchpoints are more limited

- Nudging more donations – data collected in April indicated that some members were receiving more in donations either through more proactive collection or installing contactless terminals

- Developing the venue hire offer – The Foundling Museum provided a fantastic case study of how to increase revenue in this area

- Flexible opening – in March, Titanic Belfast kept their retail store open on the evening of a large city conference; this responsive opening drove revenue that was otherwise unavailable

- High-end experiences – multiple venues are offering private, unique experiences to capture the high net worth, experience-hungry market unaffected by the cost-of-living crisis.

Members can learn much more via the Commercial Performance Barometer online dashboard where you can look at monthly data and view responses to each of our special questions. You can also read examples of best practice in the sentiment dashboard.

For more information about the Cultural Enterprises Commercial Performance Barometer please contact tom@culturalenterprises.org.uk or jon.young@decisionhouse.co.uk.